By using our website, you consent to your data being collected and used as outlined in our Privacy Policy.

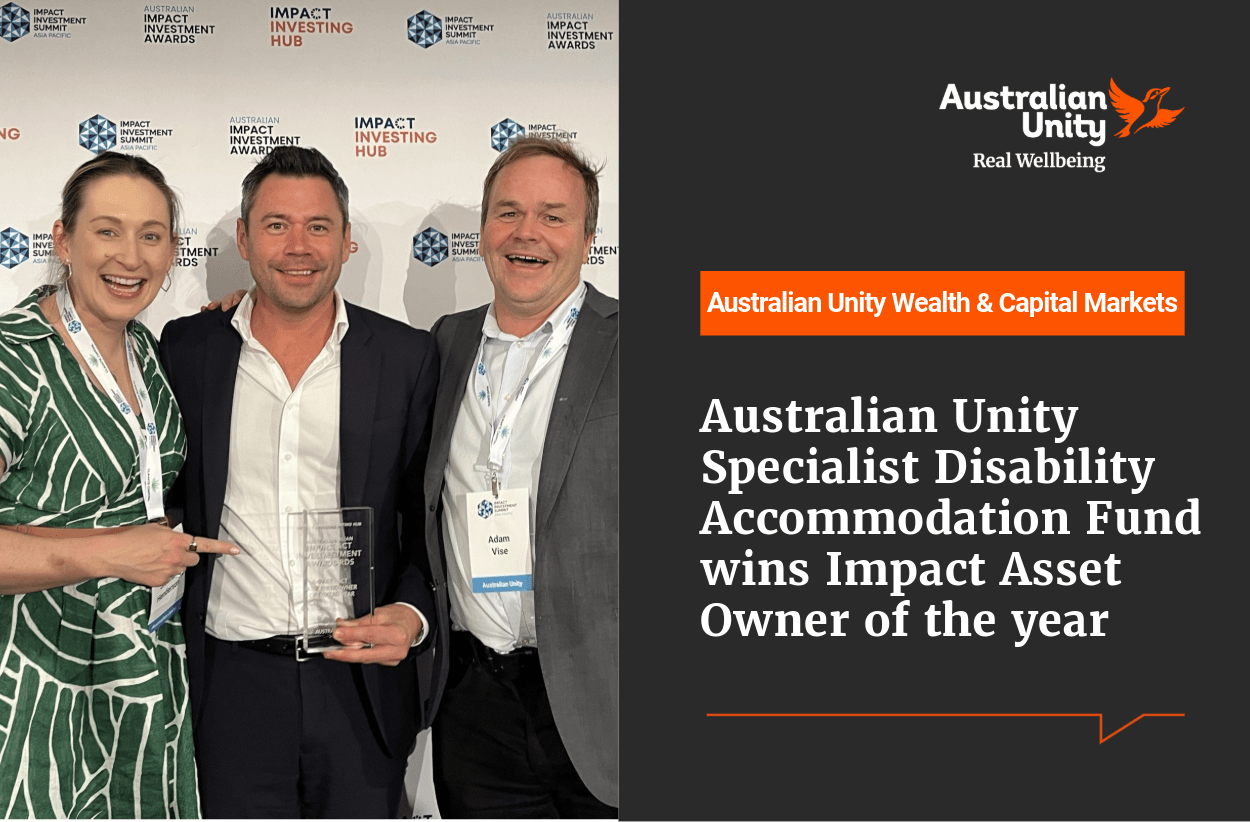

Australian Impact Investment Awards names Specialist Disability Accommodation the Impact Asset Owner of the year.

Read more

Share markets finished the calendar year weaker after an extended period of market strength while bond yields were mixed for the month.

Read more

Share markets saw strong gains in November as bond yields retraced somewhat.

Read more

Share markets declined in October as bond yields rose sharply, signalling an increased probability of a Trump election victory and ensuing policy that may result in trade wars, elevated inflation and increased deficits and debt (bond issuance).

Read more