By using our website, you consent to your data being collected and used as outlined in our Privacy Policy.

Wealth

The Childcare Property Fund is an investment vehicle that specialises in childcare centres, that uses expert sector knowledge and values-led decision-making, so discerning investors can enjoy their returns; all while contributing to the enhancement of Australia's social infrastructure and the early education of its children.

Hear how Australian Unity’s Childcare Property Fund is providing a positive social impact through direct investment into childcare real estate.

A fund focused on providing quarterly distributions, with potential for capital growth and social impact through direct investment into childcare real estate.

Aim to provide quarterly distributions, with the potential for capital growth and social impact through:

94 Child Places

In construction with completion expected in 1Q2024

Fund snapshot dated 31 Dec 2024.

The return that we aim to deliver to investors is a statement of intent, and we cannot guarantee that the Fund will achieve this return.

Units in the Australian Unity Childcare Property Fund are issued by Australian Unity Funds Management Limited (AUFM) ABN 60 071 497 115, AFSL 234454.

AUFM is part of the Australian Unity Group of companies. The information is general information only and is not intended to be relied upon as financial product advice and does not take into account the objectives, financial situation, or needs of any particular investor. In deciding whether or not to acquire, hold or dispose of the product, investors should read the Information Memorandum dated 6 June 2023 and consider whether the product is appropriate to their particular circumstances and objectives.

Prior to investing in any financial product, an investor should consult with a financial and/or tax adviser.

Investment is only available to investors who are ‘wholesale clients’ for the purposes of section 761G of the Corporations Act. This information is intended for recipients in Australia only. Past performance is not a reliable indicator of future performance.

1 Value and number of properties as at 31 Dec 2024. Valuation is based on Accounting Book Value

2 Value is based on valuations; ‘as-if-complete’ for assets in development and ‘as-is’ for assets under contract

3 Weighted average by income as at 31 Dec 2024

4 As at 31 Dec 2024

5 The return that we aim to deliver to investors is a statement of intent, and we cannot guarantee that the Fund will achieve this return

6 Department of Education, Skills and Employment Budget Statements 2023–24

7 IBIS Child Care Services in Australia August 2021

8 IBIS Child Care Services in Australia January 2020

9 An artists impression of the proposed development

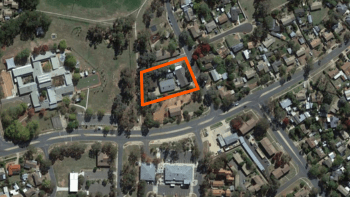

10 Aerial view of the Funds asset is within the orange outline

11 Explanatory Note to the Australian Unity Our Impact 2024 Report

12 Australian Unity Our Impact 2024 report

Complete the Application Form