What is the 125% contribution rule?

You can make additional contributions over the life of your investment in Lifeplan Investment Bond. During the first year there is no limit to the amount you can contribute. The value of putting as much in as possible during the first year is that you can contribute more in subsequent years.

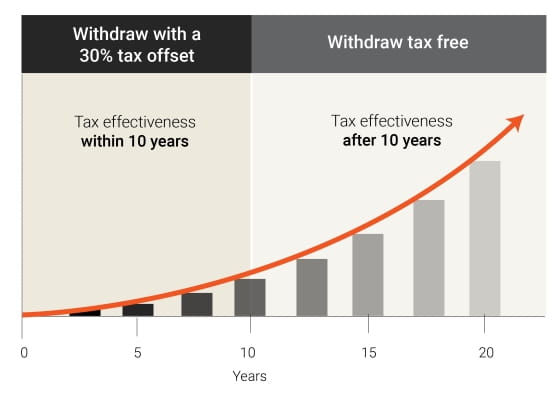

Each following year, your contribution should not exceed 125% of the previous year, because if you do, the start date of the 10-year rule will reset.

Put simply each year you can make the same contribution you did the previous year plus an additional 25%.

Setting up a regular savings plan with ongoing contributions could help you manage this.

How can the tax effectiveness be affected?

If you make a withdrawal within the first 10 years of your policy

If you contribute more than 125% of the previous year’s contributions, you will reset the 10-year period of your investment.

If you don’t make any contributions in a particular year, but then make contributions in the following year, then you will reset the 10-year period for your investment.

What are the estate planning features?

With an investment bond, a lump sum is paid tax free to your nominated beneficiaries or the estate (if no valid nomination has been made).

With Lifeplan Investment Bond you can take your estate planning one step further with Wealth Preserver. This means you can set how and when your beneficiaries are paid, without the need to set up complex trusts.

You can pay the proceeds as a deferred lump sum, an income stream, or a combination of both.

Does personal Capital Gains Tax apply?

No personal Capital Gains Tax is incurred for switching between investment options or when making withdrawals from your investment.

If you make a withdrawal from your bond within the first 10 years (in normal circumstances), your earnings will simply be assessed at your marginal tax rate. You will also receive an automatic tax offset for your personal tax– currently equal to 30% of your assessed amount.

Effectively, you must only pay personal tax (but not CGT). If your marginal tax rate is greater than 30% you will only pay personal tax on the excess.

Does this mean I do not get the 50% CGT discount?

The 50% CGT discount is only available if you are assessed for CGT.

Your realised investment bond growth is not treated as a realised capital gain, under current Australian tax rules.