Get set up in 3 easy steps

Register for Online Member Services

Get your digital card

Set up payments for claims

Manage your health insurance with ease

The Australian Unity Health App makes it simple to stay on top of your cover anytime, anywhere.

With the app, you can:

View policy details

Claim online

View extras limits and remaining benefits

Check who's covered

Access Wellplan Rewards and more

Your Australian Unity membership card

Your membership card will be delivered in the next 5–10 business days.

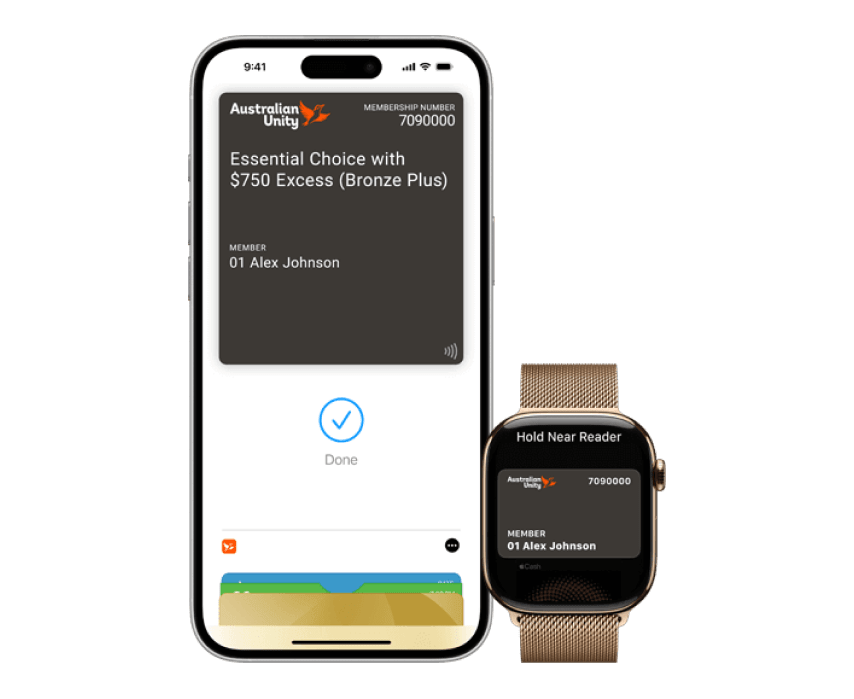

Get your digital card too

Tap and claim instantly with your digital card in the Australian Unity Health App. It’s secure, convenient and always with you on your Apple or Android device.

Understanding your premium

Private Health Insurance Rebate

To help make private health insurance more affordable, the government offers a rebate that reduces your premium. You can claim it:

- As reduced premiums throughout the year, or

- As a refundable rebate when you lodge your tax return.

Lifetime Health Cover (LHC) Loading

LHC encourages you to take out private hospital cover by 1 July following your 31st birthday and avoid paying higher premium.

Direct debit discount

If you’ve selected to pay by direct debit, you will automatically receive a 4% discount. To manage the bank account or credit card you want to use to pay your premiums, log in to Online Member Services.

Keep your waiting periods and premium to a minimum

If you’ve provided us with details of your previous fund, we’ll request a transfer certificate to confirm your Lifetime Health Cover loading amount and waiting periods you’ve already served.

We’ll keep you updated on the progress of this request and any impact to your waiting periods or premium amount. In line with industry standards, it can take up to 14 days for your previous fund to provide a transfer certificate.

If your previous fund has provided this to you directly, please send us a copy.

When to send your Transfer Certificate

We’ll need you to email us your Transfer Certificate(s) if:

You’ve purchased family, single parent or couples health cover online

You’ve had cover with more than one fund in the past 12 months, or

A family member on your policy is switching from a different fund than you.

Need Help?

If you have not provided us that fund’s details or have any questions, call us on 1300 341 688 between 8.30am - 6.00pm AET weekdays

Wellplan Rewards

Wellplan Rewards is available to eligible members at the conclusion of a 30-day period following the commencement of their private health insurance.

Be rewarded with extra perks

Get discounts on the gift cards you love at 100+ stores including: Luxury Escapes, XBOX, Freedom, Barbeques Galore, Uber Eats, Dan Murphy’s, Harvey Norman, Amazon, The Good Guys, Kmart, eBay and more.

Discover more about Wellplan Rewards

Frequently Asked Questions

As a new member to Australian Unity, here are our most frequently asked questions.

What does private health insurance cover?

There are two types of private health insurance:

- Hospital insurance, which covers all or some of the costs of hospital treatment as a private patient including doctor’s charges and hospital accommodation.

- Extras insurance (also called ancillary), which covers treatments generally not available under Medicare like dental, optical, physiotherapy, chiropractic and acupuncture.

As a general rule, the more expensive the health cover you choose, the more hospital procedures and extras treatments will be included and the more money you’ll get back when you claim.

Am I covered as soon as I take out private health insurance?

When you first buy private health insurance, or when you upgrade to a higher level of cover, you may have to wait some time before you are able to claim. These waiting periods apply to both hospital and extras.

Most private health funds recognise the waiting periods you’ve served with your previous insurer. That means that when you transfer to a level of insurance with the same (or lower) level of cover, as long as you transfer within 30 days of leaving your previous fund, you won’t need to re-serve waiting periods that you’ve already completed.

Can someone else manage my membership for me?

Yes. If you would like a partner, friend or relative to speak to Australian Unity on your behalf and manage your membership, you can either:

- Fill out this delegated authority form

- Call us on 1800 760 719

The person you nominate will then be able to access and update your personal information—both over the phone and online. You will remain the only one who can change your level of cover or cancel your insurance.

Is it easy to transfer between funds?

Yes. You can change pivate health insurance policies at any time: from one fund to another or even changing to a higher or lower level of cover within the same health fund.

You’ll receive continuous cover if you transfer to Australian Unity within 30 days of leaving your previous fund. And if you switch to an equal (or lower) level of cover, you won’t have to re-serve any waiting periods you’ve already completed.

The old fund will provide your new fund with a transfer certificate, which provides details about your level of cover, waiting periods already served, a history of recent claims, and any Lifetime Health Cover loading that applies.

This information may also be used to adjust the annual and lifetime claim limits on your new policy. For example, if you’ve made $900 worth of orthodontics claims on your old cover, and your new policy has a $2400 lifetime claim limit, that $900 will be deducted from your new policy ($2400 - $900 = $1500) to reflect your true available limit.

Find out more about switching to Australian Unity.

Will I have to serve waiting periods?

When you take out private health insurance for the first time, or when you increase your level of cover (including reducing your excess level), you’ll need to serve a waiting period before you can claim on some treatments.

This helps to keep insurance premiums lower because it stops people from making a large claim shortly after joining, and then cancelling their membership straight away.

The Australian federal government sets the maximum waiting periods that funds can impose for hospital treatment, including 12 months for pre-existing conditions and for obstetrics (pregnancy), and two months for rehabilitation and palliative care.

Do I have to pay the Lifetime Health Cover (LHC) loading?

If you're 31 or over, you might have to pay an extra 2% loading for each year you've gone without hospital cover.

The Lifetime Health Cover (LHC) loading was introduced by the Australian Government in July 2000 to encourage people to take out private hospital insurance at a younger age and maintain it over time.

Find out whether LHC affects you.

For more information about health insurance and how to use your cover, visit our dedicated Private Health Insurance FAQs page.

Be rewarded with extra perks

At Australian Unity, your wellbeing is at the heart of everything we do. That’s why we go beyond health insurance, offering a range of exclusive perks and rewards just for our members. From discounted home & contents, pet and car insurance (and more) to everyday savings, it’s our way of saying thank you.

Learn more