By using our website, you consent to your data being collected and used as outlined in our Privacy Policy.

Wealth

The funeral bond is a simple and effective way to put money aside to help meet the future cost of your funeral expenses. With a funeral bond, like Funeral Plan Management’s FuneralPlan Bond, you can decide how you want your money to be used to pay for your funeral.

The FuneralPlan Bond can be used to cover expenses such as:

With a FuneralPlan Bond invested in the capital guaranteed option, your family or nominated funeral director will always receive the amount you have saved in full, plus any interest, to pay for your funeral. Money invested in a FuneralPlan Bond cannot be taken out prior to your passing.

The Funeral Saver Safety Net could assist if you pass away before you have reached your funeral savings goal in the FuneralPlan Bond. If you are an Australian that is experiencing prolonged financial disadvantage, the Funeral Saver Safety Net can provide a top-up payment to your existing funeral bond upon your death so that your funeral expenses up to $5,000 are covered.

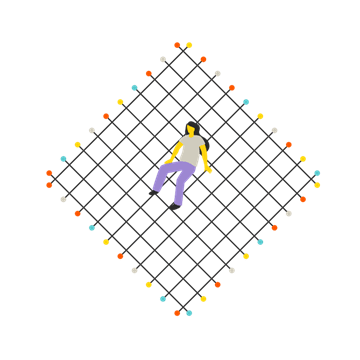

Anne is a 55 year old first nations woman who is employed part time as a community worker. She earns $40,000 a year and has been putting away $50 each month into her FuneralPlan Bond for over a year, aiming to save $5,000 to meet the estimated costs of her funeral.

Anne’s funeral bond is valued at $3,000, as Anne has met the regular minimum contribution requirements and her policy is valued at less than $5,000,if Anne suddenly passed away, her family would be eligible for a top-up of $2,000 towards her funeral costs, including costs such as a smoking ceremony and burial at her nominated location.

|

|

|

|

|

|

|

|

Anne contributes

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

Year 5

|

Funeral

|

Total Funeral Bond

|

©Funeral Plan Management Pty Ltd ABN 30 003 769 640 is a wholly owned subsidiary of Lifeplan Australia Friendly Society Limited ABN 78 087 649 492 (Lifeplan) AFS Licence 237989, Lifeplan is a wholly owned subsidiary of Australian Unity Limited ABN 23 087 648 888. Products are issued by Lifeplan. Information provided here is indicative and general in nature and has not taken into your account your objectives, financial situation or needs. Any decisions relating to a financial investment should only be based upon a consideration of your overall objectives, current and anticipated situation or needs, and should not be influenced by historical data such as past performance.

You should be careful and make sure you understand what happens to your money. You can do this by reading the Information Booklet, and the FuneralPlan Bond Product Disclosure Statement (PDS) and Target Market Determination (TMD). You should always talk to your family or ask a financial counsellor/adviser if you need help with understanding any financial products or documents.

Any tax information provided here and in any disclosure documents is general in nature and is only intended to provide a guide on how tax may affect investors. Tax laws may change in the future and may affect an investor’s tax position. Investors should seek independent tax advice relevant to their circumstances.

Register

Before applying to invest in our FuneralPlan Bond you’ll need to be a registered financial adviser with Australian Unity.

Visit our adviser portal to register. Already registered? Skip to Step 2.

Register

Once you have a FuneralPlan Bond, you can now register for the Funeral Saver Safety Net by downloading the information sheet and filling out the ‘registration of interest’ form on page 4 and sending it to Investment Bonds Australian Unity Reply Paid 93753, Melbourne VIC 8060

Adviser Services 1800 804 731