“All of the drivers of financial wellbeing are being hit at once—absolute wealth is being hit, assurance and certainty are being hit, and confidence in the future is being hit."—Esther Kerr, CEO, Wealth and Capital Markets, Australian Unity

Key points

- With cost-of-living pressures having a significant impact on our community—and things estimated to get worse before they get better—there is an opportunity for policy-makers to work towards a wellbeing economy.

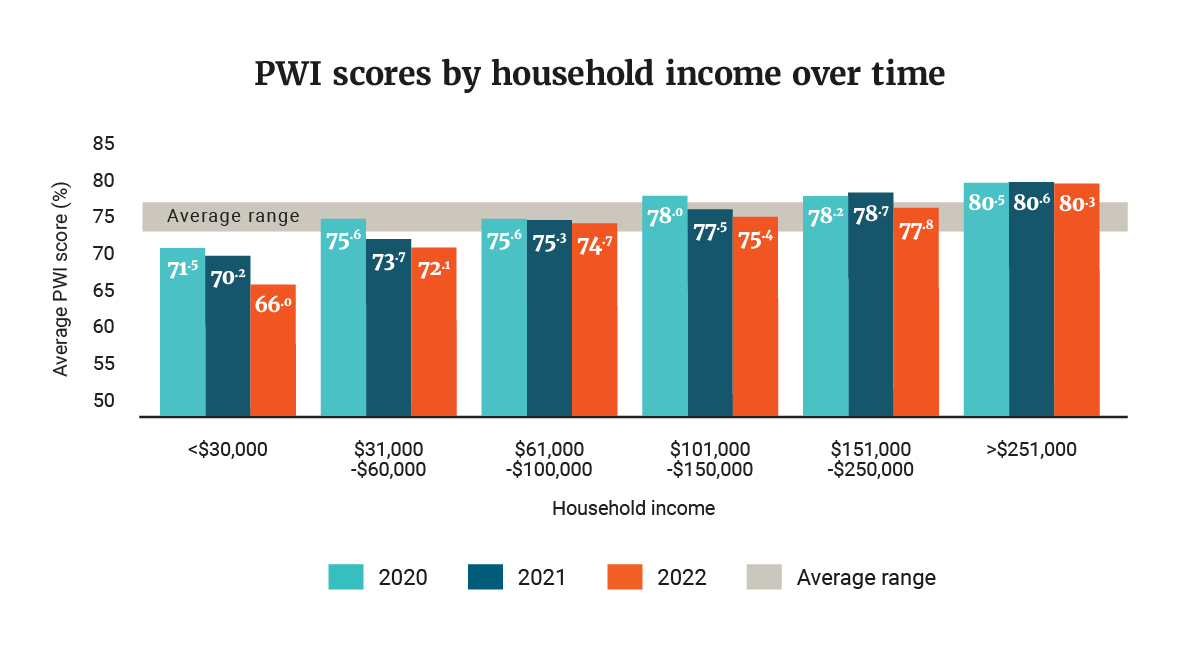

- The latest Australian Unity Wellbeing Index has found that our satisfaction with our standard of living—that is, our finances—dropped in 2022.

- The drop in satisfaction is particularly noticeable for households with an income level of less than $30,000, which reported their lowest levels of wellbeing on record.

Right now, the cost of living is one of the biggest issues dominating the news agenda. Prices for housing, utilities, petrol and groceries continue to rise, compounded by a series of interest-rate hikes. Indeed, the Australian Bureau of Statistics reported in February 2023 that the annual increase in cost of living was at the highest point for almost 33 years.

So it’s not too surprising to learn that the Australian Unity Wellbeing Index—a 22-year study into the wellbeing of Australians, delivered in partnership with Deakin University—reveals that our satisfaction with our standard of living is in decline, alongside our satisfaction with the economic situation in Australia.

But what’s really worrying is that the Australian Unity Wellbeing Index survey that produced these results took place in May and June 2022. That’s before the cost-of-living pressures really began to bite, suggesting that the true impact on our wellbeing will only be revealed in future surveys. In other words, if our financial wellbeing was on the low side last year, it’s likely to worsen in the months ahead.

.jpg)

Absorbing shock when things get tough

We know that our finances are really important to our wellbeing. In fact, over the years, the Australian Unity Wellbeing Index has found that our finances form part of the “golden triangle of happiness”, alongside our relationships and a sense of purpose.

Esther Kerr, Australian Unity's CEO of Wealth and Capital Markets, agrees that our finances play a critical role in our wellbeing, noting that they give us a solid foundation to weather storms in other areas of our lives.

“Real Wellbeing covers all aspects of your life,” Esther says. “But if you’re worried about paying the rent and having a roof over your head, if you're worried about where you're going to live in retirement and your aged care, if you don't have a sense of security around what happens when your partner passes, or you don't think that you can provide for your children—then this challenges your capacity to have a strong sense of financial wellbeing.”

It's a sentiment that was borne out in this year’s Wellbeing Index results, where the most financially vulnerable groups fared notably worse. Although wellbeing scores dropped across all household income groups compared to 2020 and 2021, the impact was most severe for households surviving on less than $30,000. These households saw their wellbeing scores fall to the lowest levels on record, while the next financial cohort—households with an income between $31,000 and $60,000—also recorded wellbeing scores below the average range.

“Low-income households have much less capacity to absorb shocks,” explains Esther. “Financial wellbeing is not about who actually loses the most money, because that will probably be those who have a higher-wealth threshold when it comes to the actual dollar amount. It will be about who's been taken closer to that moment of financial panic.”

Get set for rocky times

Interestingly, the lowest-income households recorded notably higher wellbeing scores in 2020, when the pandemic first hit. That rise is believed to have stemmed from the initial financial support provided by the Australian government, which increased the fortnightly JobSeeker payments from $550 to $1,100 a fortnight. But in 2021, the payments were almost halved again to about $620 a fortnight. At this point, wellbeing levels for people living on less than $60,000 dropped.

“What we’re seeing now is that, while middle-income people are definitely feeling the cost-of-living pressures, it's actually shifting people in low-income brackets into completely different positions of vulnerability,” says Australian Unity Wellbeing Index lead researcher Dr Kate Lycett, from Deakin University's School of Psychology.

Esther believes rocky times lie ahead, now that the safety cushions the government initially put in place to shield us from the pandemic have been removed. As a result, it’s only now that we’re being exposed to the full brunt of COVID’s disruption to businesses and the workforce.

“We artificially buffered for a few years, but I think we now have a perfect storm for financial wellbeing,” she admits.

“Cost prices are rising faster than wage growth while there’s also the collapse in house prices, which are the first point of financial security for most people. So that means people’s main asset is reducing in value, while their salary is worth less in terms of buying what they need for their families.

“All of the drivers of financial wellbeing are being hit at once—absolute wealth is being hit, assurance and certainty are being hit, and confidence in the future is being hit.”

Inevitably, Esther adds, the people who are most vulnerable to this situation are those who are living off their income rather than their assets. “If you're living hand to mouth, then you are right at the crunch point of the challenges that we're experiencing as an economy.”

Building a “wellbeing economy”

It’s shaping up to be a huge challenge for Australia as a whole. But when it comes to building a "wellbeing economy"—that is, an economy that takes a more holistic, and wellbeing-focused, view of national progress—the information that Australian Unity and Deakin University have collected over the past two decades could help shape policy responses in the coming months and years.

For Kate, one of the key insights from the 2021 survey highlighted how our wellbeing responds to fluctuations in incomes. Significantly, wellbeing levels for the people who reported rising incomes stayed the same, whereas those whose incomes fell scored much lower. “That’s consistent with the economic theory of losses hurting more than gains,” says Kate.

“The economy shouldn't just be an end in itself. It should be about people, and putting their needs back into the heart of the decisions we're making.”

Disclaimer: Information provided in this article is of a general nature. Australian Unity accepts no responsibility for the accuracy of any of the opinions, advice, representations or information contained in this publication. Readers should rely on their own advice and enquiries in making decisions affecting their own health, wellbeing or interest. Interviewee titles and employer are cited as at the time of interview and may have changed since publication.