Platinum Investment Bond ™

Investing for the future

Why should I invest?

The Platinum Investment Bond provides you with exposure to Platinum Asset Management's global equity investment capabilities, whilst offering potential tax advantages not available through many other savings and investment products.

Whether it's investing for children or grandchildren, to buy a home, fund a trip or for retirement, the Platinum Investment Bond can help you on your way with no onerous paperwork, two investment options and the ability to set-up a regular investment plan.

Why Invest with Platinum Asset Management?

It is common for investors to choose to invest their savings across different types of assets: cash, shares, government bonds, and real estate; and many choose to entrust their savings to fund managers to benefit from different strategies and styles of investing.

Platinum was founded in 1994 and is an Australian-based investment manager that focuses on one asset class - international shares, or, more simply put, we provide access to portfolios of listed companies from around the world. Platinum offers only one core investment style - we seek out companies whose true worth and prospects are yet to be fully recognised by the market. Past performance shows that our approach is one that has worked in different economic climates and withstood the test of business cycles.

For more information on Platinum, please visit our website

Tax smart investing

This is what sets the Platinum Investment Bond apart. Unlike traditional savings or investment products, the bond issuer pays the tax on your earnings as a tax paid investment at the current life insurance tax rate of 30% – which means you don’t need to include it at tax time.

The longer you invest, the more you benefit.

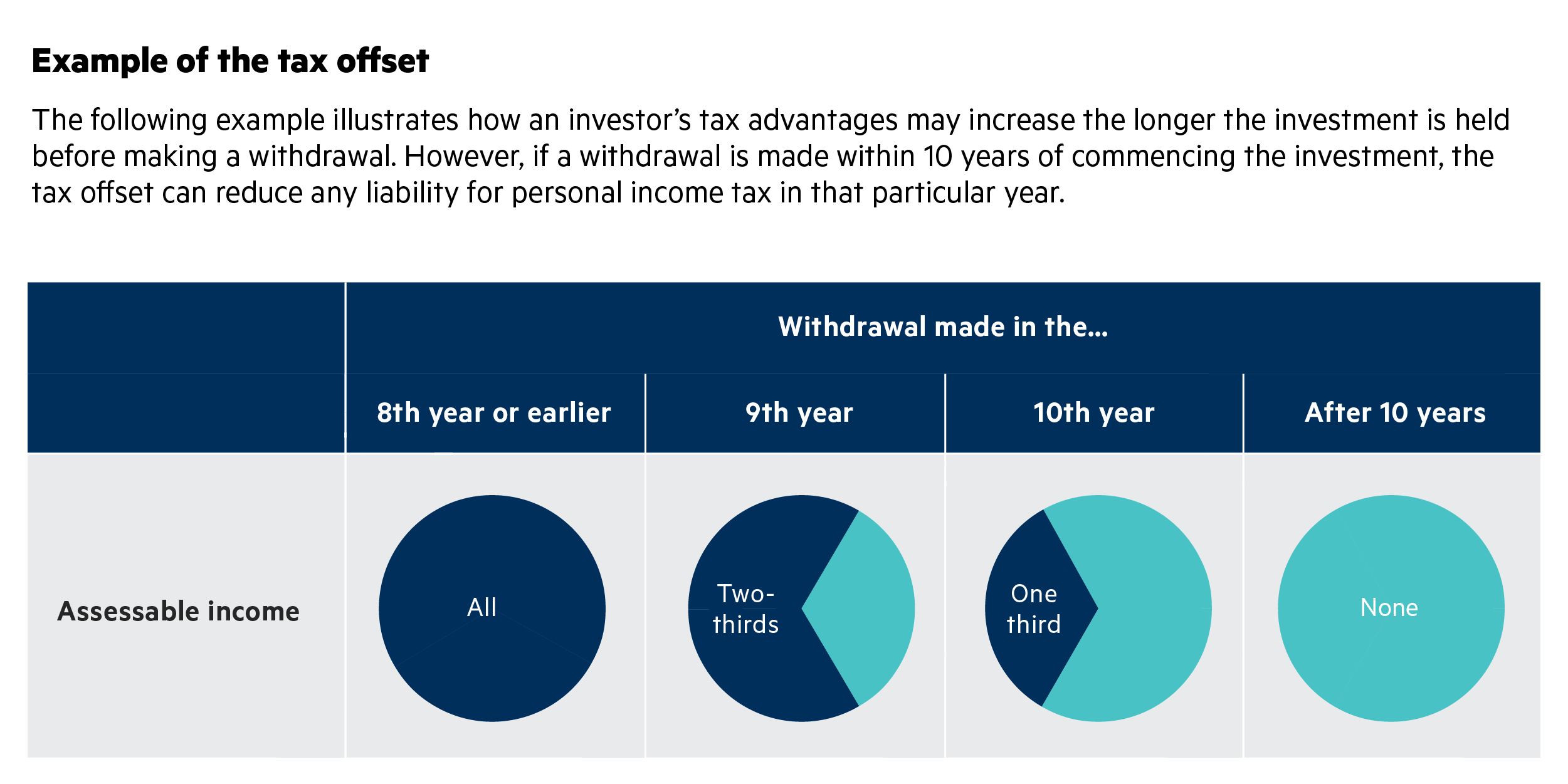

Subject to the 125% rule, you can withdraw your money after 10 years free of any additional personal income tax. Or you can access it at any time and still be eligible for a 30% tax offset for the tax already paid within the bond to help reduce any personal tax liability.

How do investment products compare?

Who is Australian Unity?

Market leading

As the leading provider of investment bonds, we have over 35 years’ experience, over $2.3 billion in funds under management (as at December 2020) and 140,000 policy holders. We know our stuff and know how to make your money work hard for you.

Experience

Established in 1840, we’re Australia’s first mutual wellbeing company. With over 180 years helping one million Australians with their health and financial wellbeing, we exist to help you thrive.

A rich community heritage

As a mutual, Australian Unity invests profits directly back into our businesses, innovation and growth to help us continuously improve the services and support we provide to our members, customers and the community.

We operate with commercial principles and with a strong social purpose to create community value. Our products and services are designed to provide peace of mind and support for members and customers at important times in their lives.

A mutual understanding

Values are important to us, that’s why we selected Platinum, an Australian based, global equities fund manager, who are also focused on helping their investors thrive.